Find out more about the Cost of Goods Sold formula and examples here. Understanding the concept of cost of goods sold (COGS) and its calculation will help businesses in reducing their total cost and calculate their gross income. No matter what type of business, the gross income is always the revenue (sales) minus the direct costs for making/acquiring that product (COGS) This information is also required for tax return filing as the cost of goods sold (COGS) contributes to the taxable income. All businesses need to track direct or indirect costs incurred in getting their product ready for sales in the market.Ĭost of Goods Sold (COGS) is significant for every business, as this number appears in the company’s profit and loss statement (P&L) aka i ncome statement and plays a vital role in calculating net income for a business. Understanding the cost of goods sold (COGS) helps businesses to find out about their financial health and profitability. Periodic inventory system is usually used by companies that buy and sell a wide variety of inexpensive products.Ī disadvantage of periodic inventory system is that overages and shortages of inventory are buried in cost of goods sold because no accounting record is available against which to compare physical count of inventory.The cost of goods sold (COGS) is a significant part of a business Income Statement and plays an essential role in calculating the net income for a business. Required: Make journal entries to record above transactions assuming a periodic inventory system is used by Paradise Hardware Store.

Purchases made during the period: 1800 units at $12 = $21,600

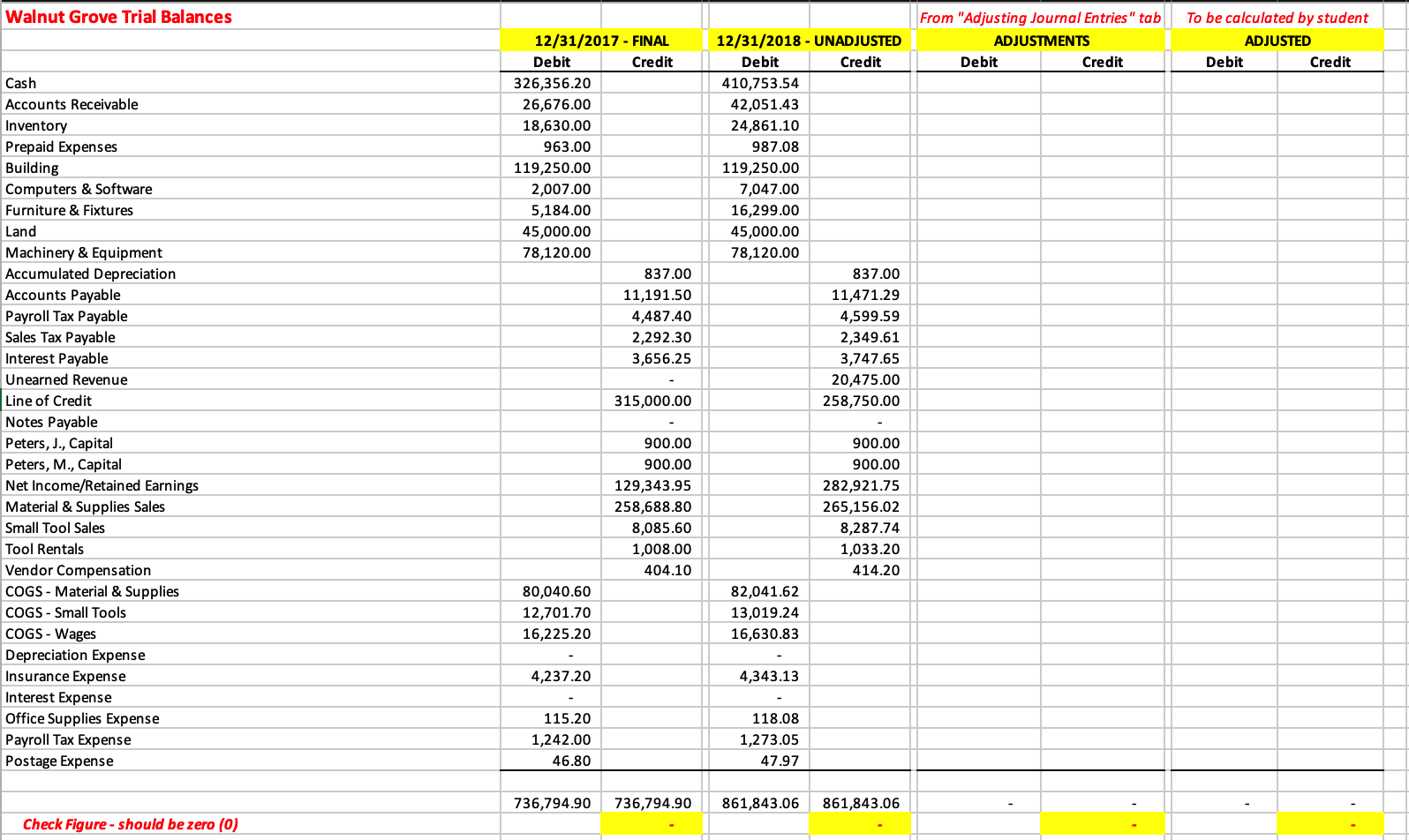

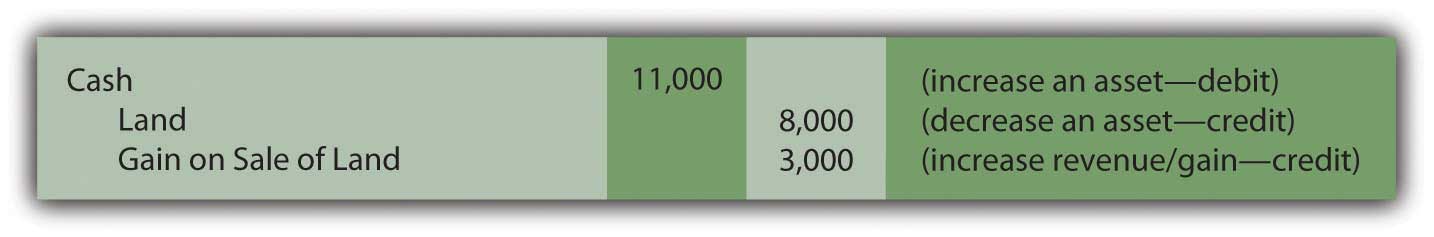

The following information belongs to Paradise Hardware Store:īeginning inventory: 200 units at $12 = $2,400 (2) When expenses are incurred to obtain goods for sale – freight-in, insurance etc: = $1,300,000 Journal entries in a periodic inventory system: Solution:Ĭost of goods sold (COGS) = Beginning inventory + Purchases – Closing inventory Required: Compute cost of goods sold for the year 2016 assuming the company uses a periodic inventory system. The following information belongs to John company, a retailer of high-end fashion products: The general formula to compute cost of goods sold under periodic inventory system is given below:Ĭost of goods sold (COGS) = Beginning inventory + Purchases – Closing inventory Example The ending inventory is determined at the end of the period by a physical count and subtracted from the cost of goods available for sale to compute the cost of goods sold. At the end of the period, the total in purchases account is added to the beginning balance of the inventory to compute cost of goods available for sale. All purchases are debited to purchases account.

Under periodic inventory system inventory account is not updated for each purchase and each sale.

0 kommentar(er)

0 kommentar(er)